By Andy May

I was annoyed at the news media arguments about whether we are in a recession. The news media are supposed to explain things, not confuse everyone with silly quotes from competing “experts.” Every freaking thing these days is political, but as someone who makes his living by investing, I need to know if we are in a recession. The news media (even the WSJ) are useless these days, that meant figuring it out. Usually, a recession doesn’t matter to me, I’d just ride it out, but with inflation nearly 10% per year, recessions matter.

As far as I can determine, there is no official agency that sets the beginning and the end of recessions. There are two main sources of these values in the United States. One is the so-called “FRED,” or the Federal Reserve Economic data group in St. Louis. This group collects and analyzes, literally, hundreds of thousands of economic data time series and provides tools to help individuals and businesses analyze the data. They prefer using a very mechanical and unbiased mathematical model of GDP data to choose the beginning and end of recessions. Their choices are here.

The second source for the beginning and end of recessions is the NBER, or the National Bureau of Economic Research. They are a private non-profit and do this in an unofficial capacity. Their choices are their collective opinion about the beginning and end of recessions. Their opinion is used in academic circles, and by some in the government.

NBER is a private institution set up by Malcom Rorty, an executive who worked for AT&T and Nachum Stone a socialist with a PhD in Economics from Columbia University. They did not agree on economic policy issues, so they made a rule that the company could provide collected data and research findings, but no one at the company would ever be allowed to make policy recommendations or publish statements on policy issues. If only more private institutes would do the same!

NBER chooses its recession beginnings and ends using subjective and vague criteria, that can be summarized as follows:

“The NBER’s definition emphasizes that a recession involves a significant decline in economic activity that is spread across the economy and lasts more than a few months. In our interpretation of this definition, we treat the three criteria—depth, diffusion, and duration—as somewhat interchangeable. That is, while each criterion needs to be met individually to some degree, extreme conditions revealed by one criterion may partially offset weaker indications from another.”

NBER

While the NBER criteria are subjective, their opinion about the beginning and end of recessions is widely trusted and used. Unlike some in the media and government have asserted, however, it is not official, it is still an institutional opinion, and should be treated that way. The real problem with the NBER opinion is that it is not published until the recession is nearly over or, sometimes, even after the recession is completely over.

FRED’s definition of a recession is built into a rigid mathematical model of the way recessions differ from expansions. FRED’s model only uses GDP data, and as a result they can determine recessions much earlier than NBER and their definition is unbiased, an advantage in these times when politics so often corrupts science.

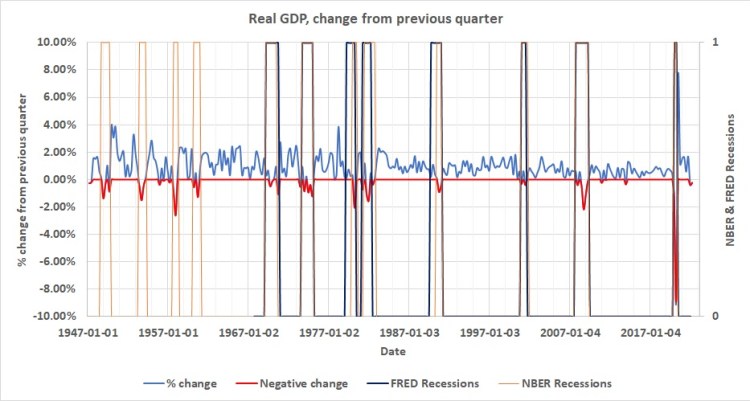

A more commonly used definition is that a recession starts whenever we see GDP contract two quarters in a row. It has the advantage that we know we are in a recession instantly; no model is needed, and it is not subjective. Figure 1 compares all three methods.

As Figure 1 shows, the three definitions agree very closely with one another. Thus, we are likely in a recession today. A word to the news media, this was not difficult. You can argue and fuss and quote differing opinions from PhD’s all day, but you will not clarify the issue for your readers and listeners. Why not do the simple research it takes to understand the published definitions and plot the data? This isn’t rocket science, you can do this.

Andy – My name is Forrest Frantz (I’m for real. You can google me). I needed to reach out to you on your article about the correlation between CO2 and global temperature. I just completed a three year study on exactly that topic. Your response was good given the information you had. Please contact me so I can show you the results where I looked at the CO2 and global temperature records from every climate center in the world–NASA, NOAA, Met Center, World (Tokyo), Berkeley Earth, RSS, UAH, MLO, SP, ASO, BRW using hourly and monthly records. The results are a bit astounding and will end the CO2 debate.

Hi Forrest,

Looking forward to hearing from you.

Sounds great, looking forward to it.